In this article we will let you know about Union Bank of India Roof Top Solar (URTS) loan scheme for PM Surya Ghar Yojana.

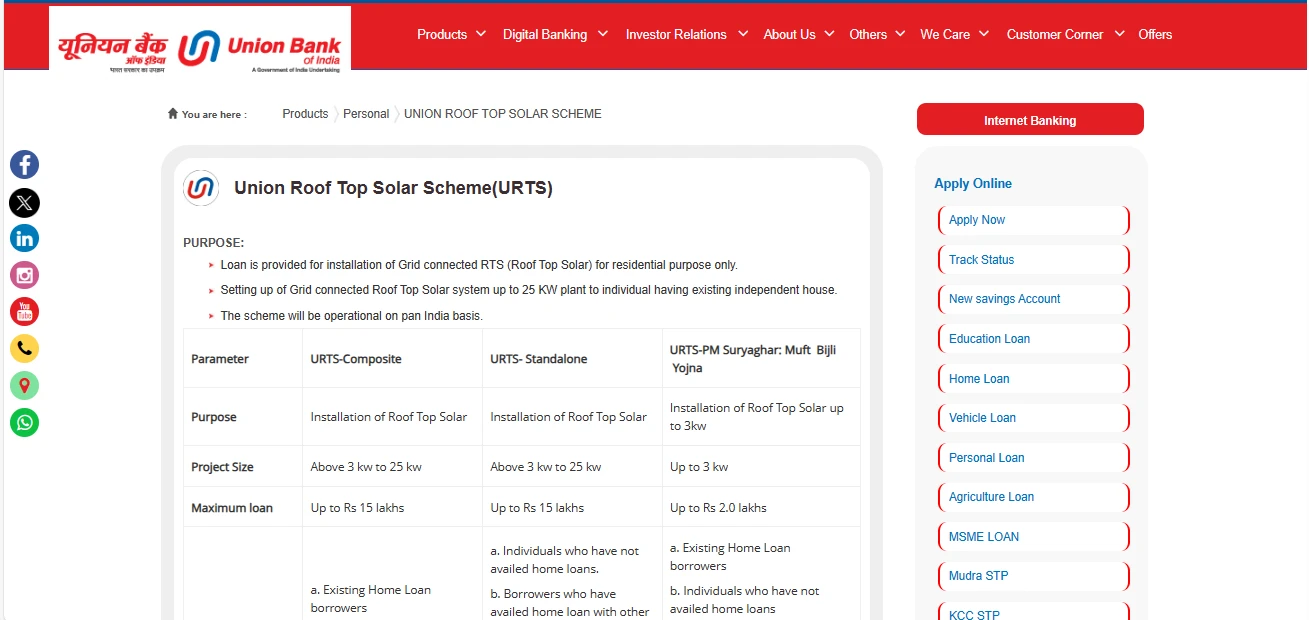

Union Bank of India offers three types of loan under this scheme: –

- URTS loan for Installation of Roof Top Solar plant up to 3kw.

- URTS loan for installation of Grid connected RTS (Roof Top Solar) plant for residential purpose above 3 kw to 25 kw.

- Union Roof top solar loan for installation of Grid connected RTS (Roof Top Solar) plant for residential purpose above 3 kw to 25 kw to individuals having Home Loan with UBI.

Now in the succeeding paragraph we will try to explain each of the above-mentioned product for you for better understanding.

It may help you to take informed decision and plan your loan requirements for installation of Roof top solar under PM Surya Ghar Yojana scheme.

Union Bank of India loan for Installation of Roof Top Solar plant up to 3kw

| Feature | URTS-PM Suryaghar: Muft Bijli Yojna |

|---|---|

| Purpose | Installation of Roof Top Solar up to 3 kW |

| Project Size | Up to 3 kW |

| Maximum Loan | Up to Rs 2.0 lakhs |

| Borrowers Eligibility | (a) Existing Home Loan borrowers. (b) Individuals who have not availed home loans. (c) Borrowers who have availed home loan with other banks (subject to submission of NOC from Bank). (d) Staff members of the UBI bank (on terms as applicable to the general public). (e) Applicants having a CIC score of 680 & above (NTB also eligible) Must have sufficient area as mandated by MNRE. (f) Latest electricity bill required. |

| ROI (Rate of Interest) | – For CIC Score 750 & Above: EBLR + 1.00% pa <br> – For CIC Score Below 750: EBLR + 1.50% pa |

| Maximum Amount | The maximum amount of loan per individual is 90% of Project Cost (as per MNRE approved dealer). |

| Self-Investment | 10% of project cost (Equipment & installation) |

| Repayment Period | Maximum 10 years |

| Moratorium | 6 months |

| Subsidy | 1 kW: Rs. 30,000/ 2 kW: Rs. 60,000/ 3 kW: Rs. 78,000/ (Subsidy to be claimed by borrower/vendor quoting the loan account) |

| Security | Hypothecation of Roof Top Solar |

| Net Annual Income | No requirement |

| Processing Charge | NIL |

| Disbursement | Disbursement to be made directly to vendor/EPC contractor after submission of all the required feasibility reports as mandated by MNRE. |

| Other Covenants | Will be sourced through Jan Samarth Portal only. Available for customer-induced journey as well as an assisted journey |

| In-principle Offer | Digital in-principal Sanction to be given based on self-declaration by the applicant. Final Sanction to be based on verification of relevant documents and assessment by the respective Banks. |

| Age | Minimum entry age: 18 years Maximum permissible age at the end of repayment: 75 years |

| Note | Loan under the scheme shall be only for individuals and not for housing societies and for commercial use. In case of a home loan account with another bank, NOC to be obtained from the existing lender prior to sanction/disbursement of the solar loan. |

Also Check Bank loan offers from other banks: – Loan Offers

Union Bank of India loan for Installation of Roof Top Solar (RTS) plant for residential purpose above 3 kw to 25 kw

| Feature | URTS- Standalone |

|---|---|

| Purpose | Installation of Roof Top Solar |

| Project Size | Above 3 kW to 25 kW |

| Maximum Loan | Up to Rs 15 lakhs |

| Eligible Borrowers | a. Individuals who have not availed home loans. b. Borrowers who have availed home loan with other banks (subject to submission of NOC from Bank). c. Staff members of UBI bank are eligible for availing loan under the scheme on terms as applicable to general public. d. Applicant having CIC score 680 & above (NTB also eligible). e. Having sufficient area as mandated by MNRE. f. Latest electricity bill. |

| ROI (Rate of Interest) | CIC Score Floating ROI 750 & Above EBLR + 1.00% pa Below 750 EBLR + 1.50% pa |

| Maximum Finance | The maximum amount of loan per individual is 80% of Project Cost (as per MNRE approved dealer) |

| Self-Investment | 20% of project cost (Equipment & installation) |

| Repayment Period | Maximum 10 years |

| Moratorium | 6 months |

| Subsidy | Subsidy amount- Rs. 78000/- (To be claimed by borrower; Loan account number to be provided for credit of subsidy amount in the loan account) |

| Security | Hypothecation of Roof Top Solar |

| Net Annual Income | As per income document |

| Processing Charge | 0.50% of loan amount plus GST |

| Disbursement | Disbursement to be made directly to vendor/EPC contractor after submission of all the required feasibility reports as mandated by MNRE |

| Other Covenants | Will be sourced through Jan Samarth Portal only. Available for customer-induced journey as well as an assisted journey |

| In-principle Offer | NA |

| Note | Loan under the scheme shall be only for individuals and not for housing societies and for the purpose of commercial use. In case of a home loan account with another bank, NOC to be obtained from the existing lender prior to sanction/disbursement of the solar loan. |

Union Roof top solar loan for installation of Grid connected RTS (Roof Top Solar) plant for residential purpose above 3 kw to 25 kw to individuals having Home Loan with UBI

| Feature | URTS-Composite |

|---|---|

| Purpose | Installation of Roof Top Solar |

| Project Size | Above 3 kW to 25 kW |

| Maximum Loan | Up to Rs 15 lakhs |

| Eligible Borrowers | a. Existing Home Loan borrowers. b. Applicant having CIC score 680 & above (NTB also eligible). c. Staff members of our bank are eligible for availing loan under the scheme on terms as applicable to general public. d. Having sufficient area as mandated by MNRE. e. Latest electricity bill. |

| ROI (Rate of Interest) | As applicable under Union Home |

| Maximum Finance | The maximum quantum of loan per individual is 80% of Project Cost (as per MNRE approved dealer) |

| Margin | 20% of project cost (Equipment & installation) |

| Repayment Period | Maximum 10 years |

| Moratorium | 6 months |

| Subsidy | Subsidy amount- Rs. 78000/- (To be claimed by borrower; Loan account number to be provided for credit of subsidy amount in the loan account) |

| Security | Hypothecation of Roof Top Solar and general lien over the title deed of property offer in existing home loan. |

| Net Annual Income | As per income document |

| Processing Charge | 0.50% of loan amount plus GST |

| Disbursement | Disbursement to be made directly to vendor/EPC contractor after submission of all the required feasibility reports as mandated by MNRE |

| Other Covenants | – Will be sourced through Jan Samarth Portal only <br> – Available for customer-induced journey as well as an assisted journey |

| In-principle Offer | NA |

| Note | Loan under the scheme shall be only for individuals and not for housing societies and for the purpose of commercial use. In case of a home loan account with another bank, NOC to be obtained from the existing lender prior to sanction/disbursement of the solar loan |

Details of Nodal Officer from the Bank

| Name | Designation | Mobile | |

|---|---|---|---|

| Sujit Kumar Suman | Chief Manager RAV CO | sujitkumar[dot]suman[at]unionbankofindia[dot]bank | 8948443448 |

Note: Check this article to know more in detail about – Subsidy Structure

Apply now:- https://pmsuryaghar.gov.in/

Hi, I am Aaditya a passionate blogger. My aim is to promote the latest Government schemes to the end users. I have been in this blogging industry since 2019 and successfully running multiple sites on different niches. Through our regular blog me and my team aims to troubleshoot your problems and help you out.

chaiye